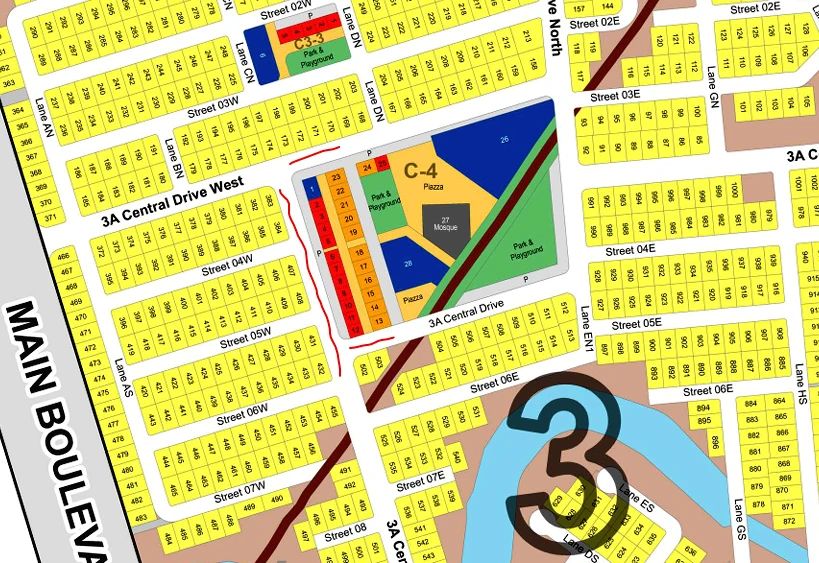

Bahria Town vs. DHA City: The 2026 Amenities & Lifestyle Review

You can stare at maps and master plans all day, but they won’t tell you what it actually feels like to live somewhere.

I recently went deep into the comparison between Bahria Town Karachi (BTK) and DHA City Karachi (DCK). But this time, I ignored the plot prices. I didn’t care about the difference between a 125 sq. yard file and a 500 sq. yard balloted plot.

I wanted to know one thing: If you moved your family here, what would your Tuesday afternoon look like?

For high-net-worth individuals, the decision often isn’t about affordability—it’s about livability. And when you strip away the marketing, these two giants offer completely different worlds.

Here is the brutally honest amenities audit.

Quick Summary: Bahria Town vs. DHA City (2026 Lifestyle Review)

| Feature | Bahria Town Karachi (BTK) | DHA City Karachi (DCK) |

|---|---|---|

| Best For | **Immediate Living:** Families who want convenience, entertainment, and a bustling community today. | **Future Security & Retreats:** Investors looking for safe capital growth or families wanting a quiet farmhouse getaway. |

| Current Vibe | Polished, loud, and resort-like. Feels like a fully functional modern city. | Quiet, raw, and secluded. Feels like a secure “fortress” still under construction. |

| Education | Multiple top-tier schools operational. | Roots Millennium School is active and built (impressive for the low population). |

| Healthcare | Fully functional world-class hospitals. | Shaukat Khanum Hospital structure is visible (major future asset), but not yet open. |

| Daily Conveniences | **High.** Supermarkets (Imtiaz, Green Valley), banks, and endless dining options. | **Low.** Limited to basic marts (Royal Mart), a few banks, and roadside snacks. |

| Recreation | **High Energy:** Theme parks, cinemas, dancing fountains, golf course, fine dining. | **Low Key:** Adventure park (ziplines), dinosaur park, and replica landmarks. Focus is on private Farmhouses. |

| Maintenance | Manicured perfection. Constant cleaning and gardening. | Solid but rougher. Overgrown green belts and some debris, though solar lighting is excellent. |

| The “X-Factor” | **Livability:** You can move in tomorrow and not miss a single city comfort. | **The Farmhouses:** Luxury 1,000+ sq. yd. estates with pools that generate high daily rental income. |

| Verdict | The City You Live In. | The Town You Wait For. |

The “Vibe” Check: Resort vs. Fortress

Let’s start with the atmosphere because you feel it the moment you drive through the gates.

Bahria Town feels like a manicured resort. It is loud, it is proud, and it is undeniably “finished.” The roundabouts are perfect, the fountains are dancing, and there is a sense of activity. You see families, you see traffic, you see life.

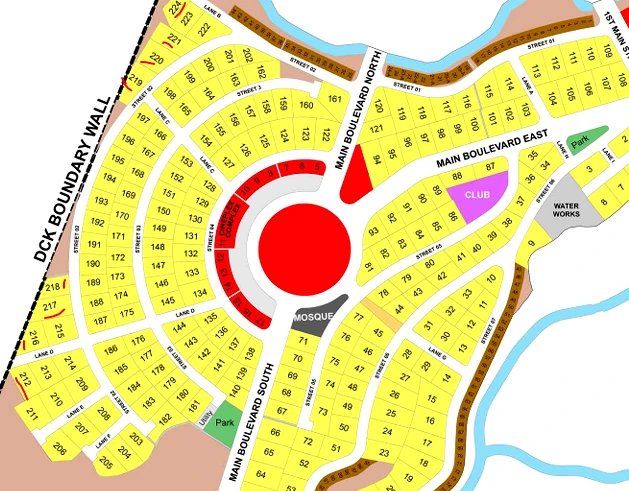

DHA City is different. Driving there (about 20 minutes past Bahria), the silence hits you.

It feels like a fortress that is still waking up. The video tour I watched recently described it as a “jungle” in some parts—and they weren’t wrong. It’s quiet. The air is cleaner, but the streets are empty.

-

Bahria Town: You go there to be seen and to be entertained.

-

DHA City: You go there to disappear and find peace.

The Amenities You Can Actually Use (Right Now)

Developers love to sell you computer-generated images of “future” golf courses. I’m interested in what is physically standing on the ground today.

1. Education & Healthcare

This is where DHA City is surprisingly strong, considering its low population.

The School Factor

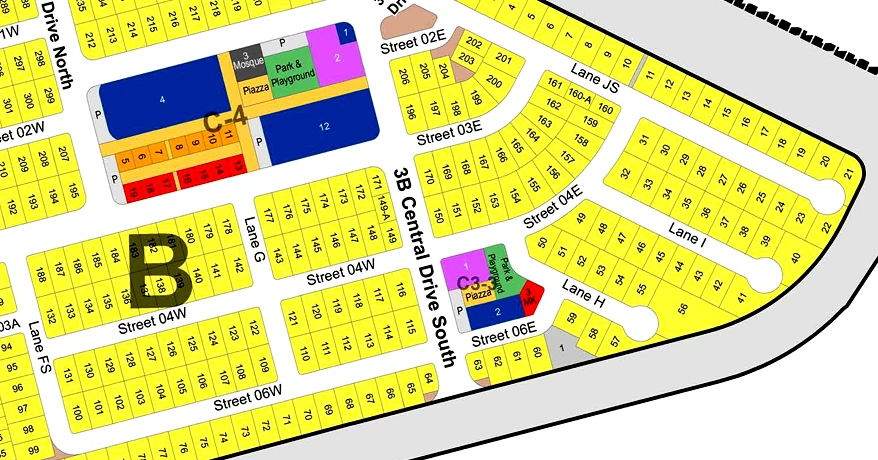

DHA City has a massive Roots Millennium School fully built and operational. It’s a serious campus. If you moved there, your kids have a top-tier place to study. Bahria has more options, obviously, but DCK isn’t a desert for education.

The Hospital Race

This is the big one. Shaukat Khanum Hospital is under construction in DCK. You can see the grey structure; it’s real. Once that opens, the entire gravity of the area shifts. It brings doctors, staff, and immediate rental demand. Bahria has world-class hospitals too, but having a brand name like Shaukat Khanum is a massive anchor for DCK’s future.

2. Leisure & Weekend Spots

Here is where the gap widens.

In Bahria

You have the carnival, the cinema, the dancing fountain, and a hundred restaurants. You can have a different dinner every night for a month.

In DHA City?

You have a cafe that is located right at the entrance, right behind the containers of Estate Agencies, adventure park, go cart.

“Okay, that’s a bit harsh, but not by much. The video tour showed a few spots:”

Adventure Park

The Thrill Hills Adventure Park offers zip lines and some outdoor activities. It looks fun but quiet.

The “Replica” Zone

They are building replicas of Karachi’s icons—Frere Hall, Mohatta Palace, Empress Market. It looks impressive for a photoshoot, but it doesn’t replace a functional commercial zone.

Dining

There are very few options. If you want a late-night coffee or a fancy steak, you are driving back to the highway or to Bahria.

3. The “Oasis” Exception

There is one massive exception to DCK’s “quiet” reputation: The DHA Oasis Farmhouses.

This is a lifestyle product that Bahria struggles to match directly. These are 1,000+ square yard estates with private pools. They are finished, they are luxurious, and they are actually generating income.

People are renting these out for 40,000 to 50,000 PKR per day for family getaways. If your goal is a weekend luxury retreat rather than a daily residence, this is the crown jewel of DHA City amenities.

Maintenance & Infrastructure: The Nitty-Gritty

This was the most shocking part of the recent on-ground inspection.

We assume DHA means perfection. But right now? The maintenance in DHA City is a step behind Bahria.

-

Green Belts: In DCK, we saw overgrown bushes and wild grass. It looks a bit untamed.

-

Roads: The roads are solid (it is DHA, after all), but they lack that obsessively polished look of Bahria’s main avenues.

-

Lighting: DCK has gone heavy on solar street lights. This is a brilliant long-term move for sustainability, even if the current surroundings look a bit barren.

| Feature | Bahria Town Karachi | DHA City Karachi |

|---|---|---|

| Grocery & Daily Needs | **Full supermarkets** (Imtiaz, Green Valley) active. | Small marts (Royal Mart) available, but limited variety. |

| Banking | Every major bank has a branch. | Bank Al Habib & Allied Bank are active and operational. |

| Security Perception | High private security, but open access. | Feels like a **secure, gated cantonment**. Very strict. |

| Dining Options | **Endless.** From fast food to fine dining. | Extremely limited. Mostly roadside snacks or small cafes. |

| The “Noise” Factor | Can get noisy/traffic-heavy in key precincts. | **Pin-drop silence.** |

The “ARY Laguna” Elephant in the Room

We have to talk about it.

If you are buying in DCK because of the “Crystal Lagoon” lifestyle promised by ARY Laguna, you need to temper your expectations. The on-ground reality is slow. As the reviewer noted, it feels like it’s been under construction for ages with little visual progress compared to the hype.

Do not bank your lifestyle on swimming in that lagoon anytime soon. Treat it as a bonus if it happens, not a guarantee.

So, Which Lifestyle Fits You?

This isn’t about which plot makes more money. It’s about how you want to live.

Choose Bahria Town if:

-

You want convenience today. You want to order Foodpanda, go to the movies, and send your kids to school without a long commute.

-

You like the energy of a functioning city.

-

You don’t mind the “commercial” feel of the place.

Choose DHA City if:

-

You are an Overseas Pakistani who wants a secure retirement home in 5 years, not today.

-

You value privacy and silence over cinemas and malls.

-

You want the farmhouse lifestyle—spending weekends in a private pool villa while holding a secure asset.

The Final Word

Bahria Town is a city you live in. DHA City is a town you wait for.

The amenities in DCK are foundational—schools, banks, hospitals. They are the things you need. The amenities in BTK are aspirational—theme parks, Eiffel Towers, fine dining. They are the things you want.

For the serious investor, the “boring” amenities of DHA City (the hospital and the school) are actually excellent signals. They suggest real, sustainable population growth is coming—just not tomorrow.

What’s your priority? Do you need a house that functions today, or an asset that secures your tomorrow?